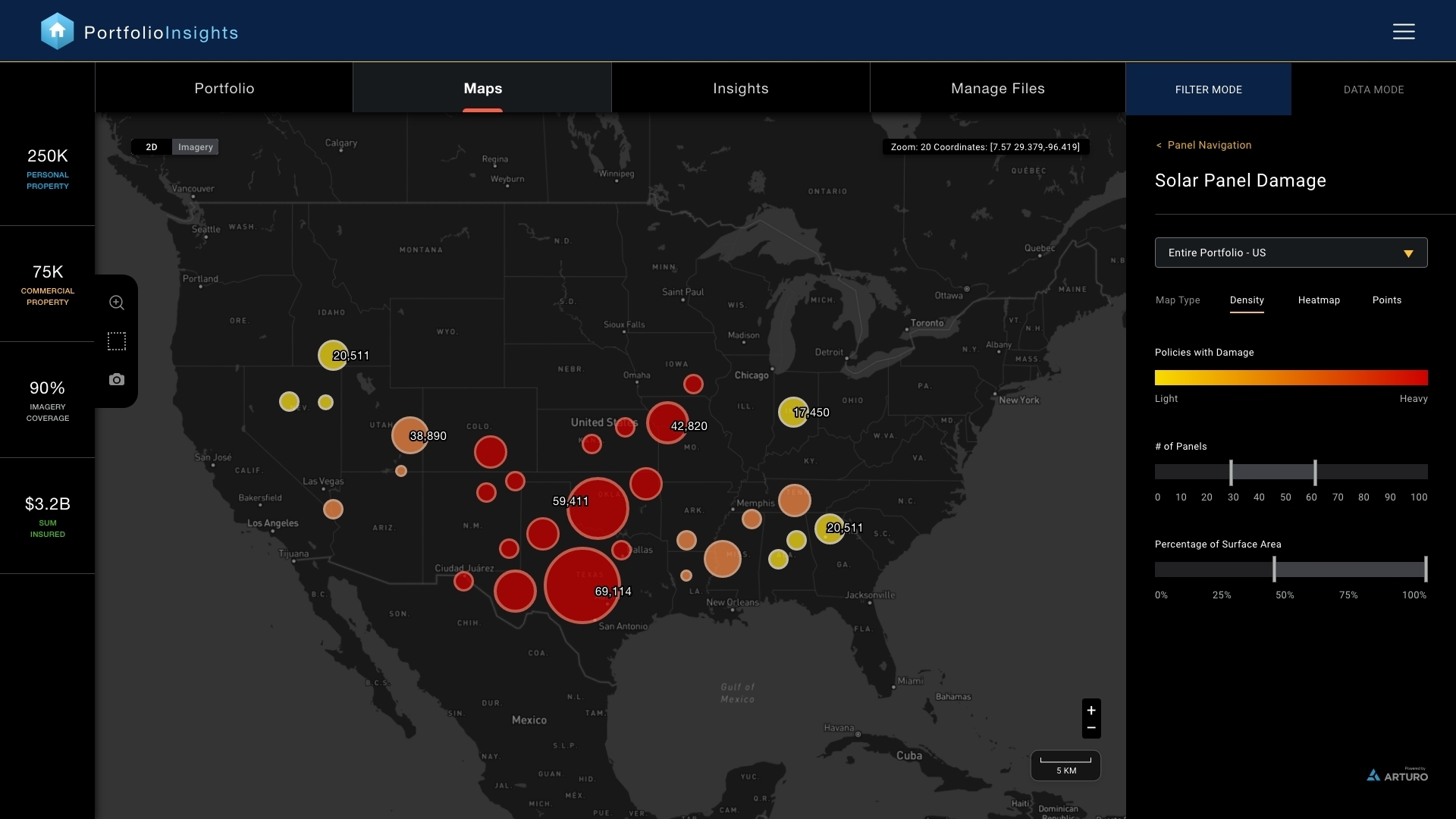

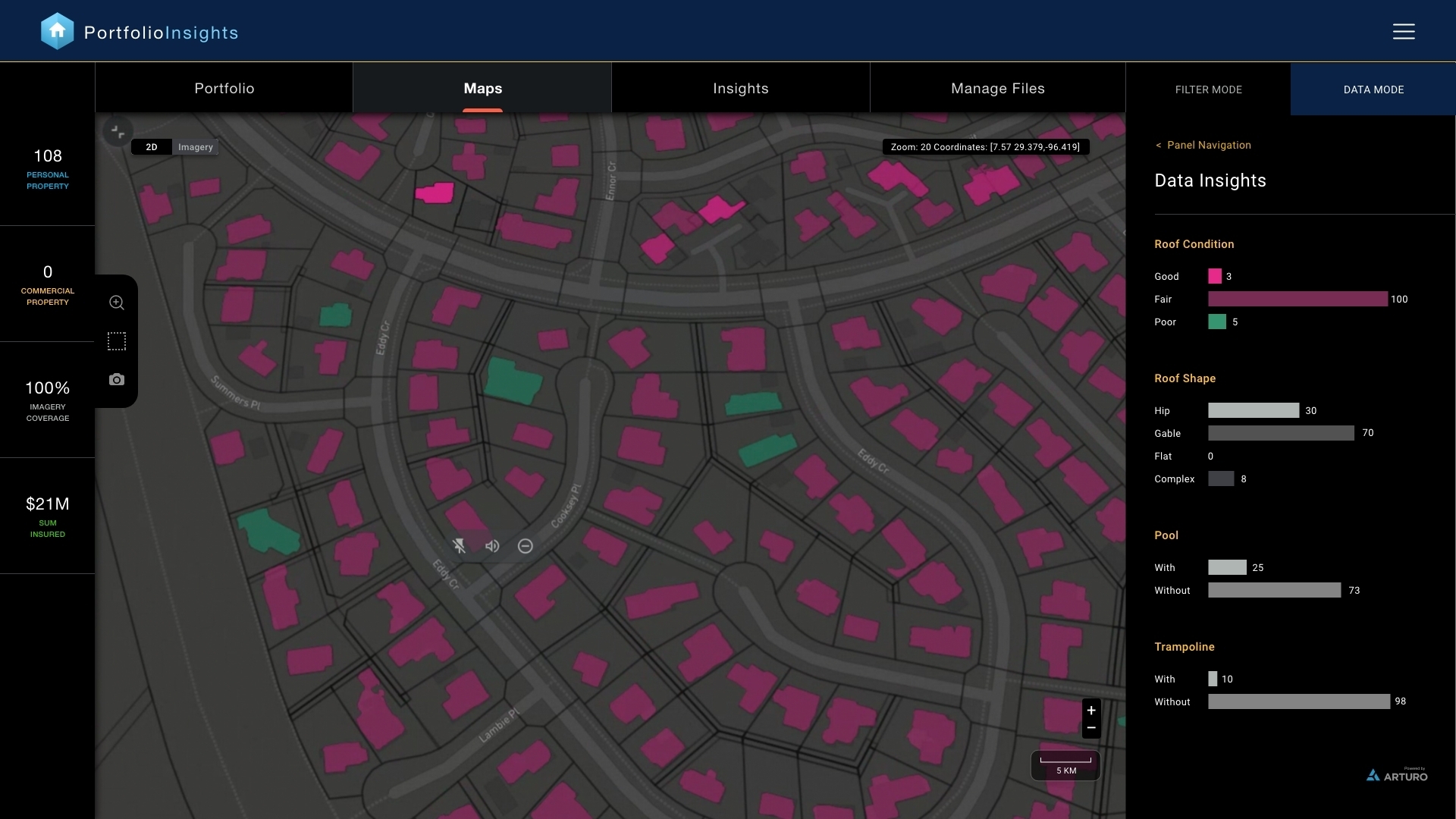

Say Hello to PERI

Arturo's Portfolio Engine & Risk Intelligence Platform

-

Visualize your risk across the policy lifecycle

-

Segment, monitor, manage and respond to risk at the property and portfolio-level

Interested in Early Access?

Or just curious to see a sneak peek? We’ll be in touch for a consultation and to share the latest.

Address any problem, big or small

From visualizing risk in underwriting, flagging change detection for renewals, and triaging claims, insurers can leverage these insights to build a stronger book and nurture healthy combined ratios.

Arturo enables insurers to think big for portfolio-level decisions but zoom in for point-level tactical decision-making to boost their combined ratio and decide with intelligence.

Build an intelligent portfolio

Automated Underwriting

Monitor property changes and risk factors to automate bind and renewals.

Premium coverage optimization

Proactive risk mitigation

Monitoring trends

Plan at the local level with insights on the distribution of brands, policy types of concentration of attributes.

Claims triage

Resilience planning

Reveal actionable truth

By pairing policy addresses with Arturo’s AI-derived property characteristics, you can take advantage of new insights.

Now, you can ladder up structure information, like roof materials, solar panel count, and more. With this aggregated analysis, you can plan at the local level, sending out targeted communications to policyholders to incentivize better behavior. You can also better prepare and capitalize for potential costs around claims.

Discover more about Arturo's portfolio engine

Press Release: Arturo Expands Offering with an Intelligent Portfolio-Level Risk Engine

Arturo aims to elevate insurers from property-level decision-making to better respond to the changing climate, resilience and vulnerability of the property ecosystem. This dynamic, role-based portfolio management solution pairs policy addresses with AI-derived property characteristics to give insurers intelligence at scale.

About Arturo: Decide with Intelligence

When you need instant, in-depth, accurate knowledge of every property, Arturo delivers. Create exceptional policyholder experiences, reduce operating costs, get unbeatable roof condition attributes, and work seamlessly.

Data Sheet: The Intelligent Portfolio Risk Engine

Get more information on Arturo's intelligent portfolio risk engine and how it helps property insurers segment, monitor, manage and respond to risk across an entire portfolio.